Not known Incorrect Statements About Hard Money Atlanta

Table of ContentsHow Hard Money Atlanta can Save You Time, Stress, and Money.The 4-Minute Rule for Hard Money AtlantaUnknown Facts About Hard Money AtlantaHard Money Atlanta - The Facts6 Simple Techniques For Hard Money Atlanta

These projects are normally finished quickly, thus the demand for quick accessibility to funds. Benefit from the job can be used as a down repayment on the next, for that reason, difficult cash lendings permit financiers to scale and also flip even more homes per time - hard money atlanta. Considered that the dealing with to resale amount of time is brief (generally less than a year), home fins do not need the lasting finances that conventional home mortgage lenders supply.By doing this, the task is able to accomplish conclusion within the set timeline. Standard lenders may be considered the reverse of tough money lenders. So, what is a tough money lender? Tough cash loan providers are generally personal companies or specific investors who use non-conforming, asset-based car loans mostly to real estate capitalists.

Normally, these elements are not the most essential factor to consider for car loan credentials. Interest rates may also differ based on the lending institution as well as the offer in concern.

Hard cash loan providers would certainly also bill a fee for supplying the loan, and these costs are likewise recognized as "points." They normally wind up being anywhere from 1- 5% of the total finance amount, nevertheless, points would generally amount to one percentage point of the funding. The major difference in between a hard money loan provider and also other lending institutions lies in the approval process.

The Ultimate Guide To Hard Money Atlanta

A tough money lender, on the various other hand, concentrates on the possession to be purchased as the leading consideration. Credit report, revenue, and also other private needs come second. They also differ in terms of ease of access to funding and also rate of interest prices; tough cash lenders offer moneying swiftly and charge higher rate of interest prices.

You could discover one in among the following means: A basic internet search Demand recommendations from local genuine estate agents Request referrals from genuine estate capitalists/ capitalist teams Since the lendings are non-conforming, you must take your time assessing the demands as well as terms provided before making a calculated as well as notified choice.

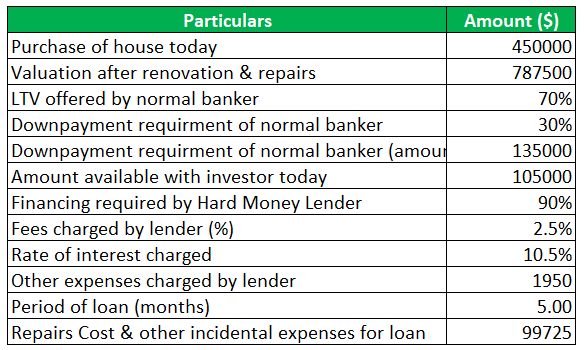

It is important to run the figures before choosing for a hard cash loan to make sure that you do not encounter any loss. Make an application for your tough cash financing today and also obtain a finance dedication in 24 hours.

These finances can normally be acquired extra quickly than a standard lending, and commonly without a large down payment. A hard Full Report money lending is a collateral-backed funding, secured by the genuine estate being purchased. The dimension of the car loan is determined by the approximated value of the residential or commercial property after recommended repair work are made.

3 Simple Techniques For Hard Money Atlanta

Most hard cash fundings have a term of six to twelve months, although in some instances, longer terms can be organized. The borrower makes a regular monthly settlement to the loan provider, generally an interest-only repayment. Below's just how a regular hard money financing functions: The customer desires to purchase a fixer-upper for $100,000.

Keep in mind that some lending institutions will need more cash in the offer, and ask for a minimum deposit of 10-20%. It can be advantageous for the capitalist to choose the loan providers that require marginal deposit options to lower their money to close. There will additionally be the normal title fees connected with shutting a purchase.

See to it to contact the tough money loan provider to see if there are early repayment fines billed or a minimal yield they require. Assuming you are in the financing for 3 months, and the building sells for the projected $180,000, the capitalist earns a profit of $25,000. If the home markets for even more than $180,000, the purchaser makes more money.

Due to the shorter term as well as high interest prices, there normally needs to be renovation as well as upside equity to record, whether its a flip or More Help rental residential property. First, a difficult cash finance is optimal for a buyer that intends to fix and flip an undervalued residential property within a reasonably short time period.

Fascination About Hard Money Atlanta

It is essential to know how hard money loans job and just how they differ from traditional fundings. Financial institutions and also other traditional financial institutions originate most long-lasting financings and also mortgages. These conventional lenders do not typically handle tough cash fundings. Instead, tough money finances are released by personal capitalists, funds or brokers who ultimately source the offers from the exclusive read this article financiers or funds.

Some Known Questions About Hard Money Atlanta.

When applying for a tough cash funding, borrowers need to verify that they have enough funding to efficiently get via a deal. (ARV) of the building that is, the estimated value of the building after all improvements have actually been made.